Happy New Year, Readers!

2020 finally came to a close - With the ongoing Covid-19 situation, it was a year unlike any others compared to the years before. Many faced difficulty, be it individual or businesses alike, and if it weren't for government intervention, it could have been far worse. Those that managed to brace themselves and come out stronger.

And there are some who managed to seize the opportunity, in the form of the market crash, to bring their financial target years ahead - well done to those that have had their efforts bore fruit.

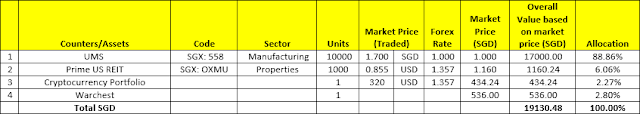

In a surprise move, I have decided to liquidate my major positions, leaving only Prime REIT (SGX: OXMU) as my only stockholding.

See: Link to Main Portfolio page

Contents:

- Portfolio (31 December 2020)

- Transactions and Dividends

- Year End Reflection/Review

- Closing Thoughts

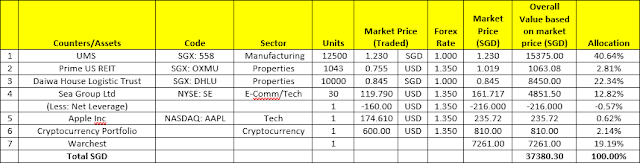

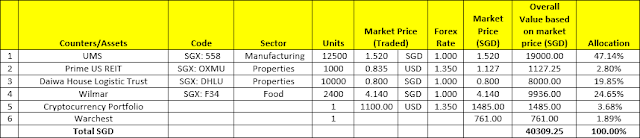

Portfolio (31 December 2020)

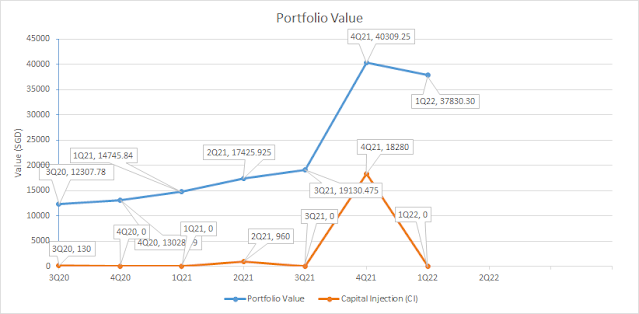

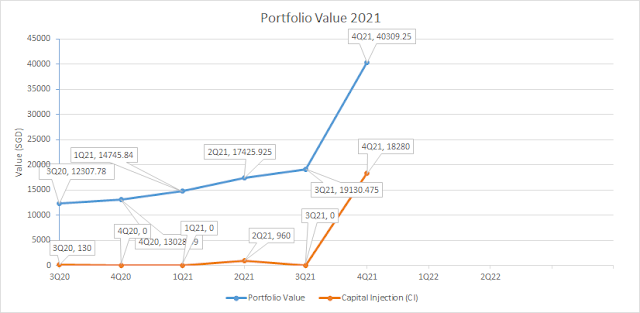

Performance

Some commentary on my portfolio- I managed to barely touch SGD 13000 on my portfolio thanks to the Christmas rally?

- Overall

(back to top)

Transactions and Dividends

(a) Transaction Summary

- Sold the following on 31 December 2020:

- Fu Yu Corporation: Sold 11000 units at 0.260

- Capital Gain/(Loss): (SGD 332)

- Dividends reduces overall losses to (SGD 173.5)

- Lendlease Global Commercial REIT (LREIT)

- Capital Gain/(Loss): (SGD 10)

- Wilmar

- Capital Gain/(Loss): SGD 260

(b) Dividend Summary

- No new dividend declared or received in the month of December 2020.

(back to top)

Year-End Reflection

2020 coming to a close also meant it's time for this annual internalisation for the investment year.

What did I do well?

Managing to inject at least 6000 into the portfolio. This year was specially catered for me to build up on my savings to prepare to start a family, so to be able to still inject capital was pleasantly surprising. Having said that, it is still not to the ideal I have in mind. What I really want is to be able to consistently inject SGD at least 12000 yearly which is pretty challenging at my pay grade after having personal committment.

This is more of a consolation, but I am also glad to be close to breakeven after averaging down on and then selling off LREIT to recover from bad positioning in my initial buy last year.

What did I not do well in?

Letting FOMO bite hard when I bought Fu Yu on a high, only to have it not be anywhere near again.

Not seizing the opportunity to buy closer to lows. Big part of this was not having a strong enough conviction (it is painful having fear breathed into you by your loved ones with no experience in the stock market).

Lastly, not being "strict/demanding" enough, and not establishing some methodology with my entry/exit plans in my investment plans. This is probably the root cause behind FOMO on my initial buy on Lendlease REIT / Fu Yu Corp.

(back to top)

Closing Thoughts This Blog

Ending it off, I may be going back to the

quarterly portfolio update - with these major positions offloaded, I see

little point in sharing Portfolio updates.

On the Investment Front

I will remain steadfast and continue my march onwards to recoup my losses from investing in Alita Resource.

First, what is my investment plan for 2021?

To begin, I would like to be able to inject at least an additional SGD 9000 into the portfolio.

Next,

it would be to either rebalance my stock portfolio or be able to

increase my capital through trades. Where a rebalance is done, it would

probably be biased towards positions in stocks that are in

semi-conductor manufacturing or tech industry, or otherwise, stocks that

will be inherently resilient in the face of Covid-19. Recovery plays will be second priority, and only if the price is right.

Having said that,

I will not rule out buying back what I have just sold provided the

price is a bargain. The idea is not solid, but I have a watchlist of

stocks I am interested in. Selling my major positions now gives me the

flexibility to position myself in either way (trades or longer-terms).

Personal/Career

Project is ramping up and I spent half of December with OT, so have been quite exhausted

To be honest, I find my source of income from working not keeping up fast enough with what I have in mind (a few hundreds off monthly). Cost of living is always increasing and if not managed properly, I cannot keep pace with my investment targets. Presently, I'm still some ways off 60K p.a. (an amount that I see as a prerequisite to help me meet the target.)

I will continue my journey to pick up knowledge in Data Science and learning Python in my free time, as well as find opportunity in my present line of work (manufacturing) to apply these knowledge so it also becomes work experience I can put up onto my skillset. Either I continue staying in manufacturing environment but manage it in a way the new skillsets can pivot me towards career progression, or I change my career path altogether.

On a more personal side, the plan is to try to start a family after 1Q2021. I am still trying to figure out how to ensure I can still keep to my investment targets in the years ahead thereafter.

(back to top)