Hi readers, 2021 is finally coming to an end and I hope your investing journey had been fruitful. This year has been a significant one for my investing journey - read on to find out!

See: Link to Main Portfolio page

Contents:

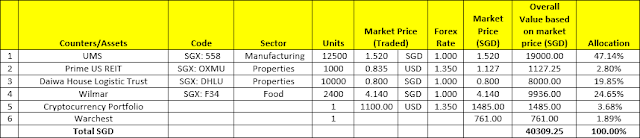

Portfolio (4Q2021 - 31 December 2021)

Performance

Some commentary on my portfolio

- I saw opportunities in adding position to one of my altcoin after a momentary dip caused by hackers attacking BitMart and selling the affected token.

- A quarter ago, UMS was carrying the portfolio. Since then, still carrying haha. True to my estimations in my 3Q2021 Portfolio review, UMS was mostly hanging about 1.30 - 1.50, and today it broke 1.50. If it does convincing break up towards 1.60 - 1.80? It'll make me a very happy person.

- Very heavy capital injection this year, with the purchase of both Daiwa and Wilmar - but to be frank, Wilmar is more of a multi-week to multi-month trade idea. The capital injection towards buying Wilmar also means that I had injected 2022's capital in advance and I may not be able to inject significant lump sum for year 2022.

Transactions and Dividends

(a) Transaction Summary

- Bought 10000 units of Daiwa Logistic REIT (SGX: DHLU) at 0.805.

- Bought 2400 units of Wilmar for 4.06 (SGX: F34)

- Bought about 280 USD of cryptocurrencies (after taxation).

- Received SGD 100 in dividends from UMS in October 2021

- Received SGD 125 in dividends from UMS in December 2021

- Received total of 2500 bonus shares from UMS (it was 1 bonus share for every 4 shares I have)

Reflections

On the Investment Front

So how did I do for 2021?

Overall, I am pleased to see that in terms of stock investments, the market has been rather kind to me,especially considering half of the UMS I bought was an accident, but I'll take any luck I can get. I am also sitting on small gain on Wilmar at the moment.

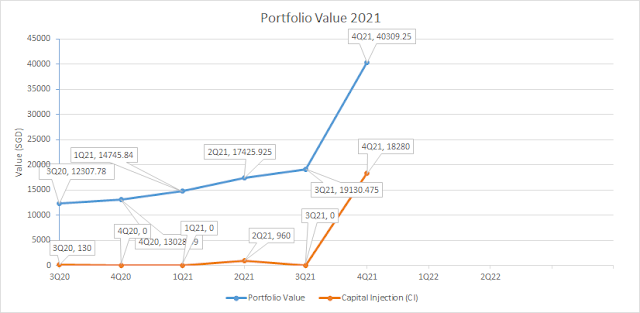

This year was also significant in that I have again broke my previous highest portfolio value record - today it sits just slightly above SGD 40000, and the last time my portfolio hit a high, it was about SGD 30000 and back in 2018 before I liquidated my stock portfolio heavily to buy my home.

Cryptocurrency portfolio is slightly up, getting carried by 2 of my major positions. One thing I am looking forward to in the coming years is how SafeMoon is moving forward not just as a cryptocurrency, but as a tech company - its own Blockchain, involvement in clean energy and beyond. Shitcoin? Memecoin? I don't think so.

Back in 1Q2020, I wrote down my investment in Alita Resources (SGX: 40F) (formerly known as Alliance Minerals Asset Limited). This represents a hefty loss of about SGD 9,800. Motivation certainly took a beating as I also did not have the means to capitalise well on March 2020 crash. I did not state in writing, but I had set a goal towards recovery from the loss within 3 years. I was rather pessimistic that given my investing performance in 2020, this might still not be met.

Fast forward since then, I am thankful I have ended 2021 with combined realised gains and paper gains making up about 80% recovery from this loss, and this is getting me pumped to keep the momentum forward.

Personal

On the personal end, we are counting down to welcoming my baby boy sometime in February 2022. Logistically, we are mostly ready, but the expenditure has been rather heavy, and I do not expect it to let up soon. One worry I have is how to ensure I still have adequate money for investment, or how to expedite portfolio growth without ill discipline.

With the impending addition to the family, I started to think how can I keep at least an acceptable savings rate even with all the expenses acting as the headwind. Seems there are only 2 realistic ways to proceed: Increased salary by way of career progression or jumping industry, and income from trades with effective recycling of capital.

What's Ahead

Thematically, this is what I think may be in focus for year 2022:

- Interest Rate Hikes leading to a positive focus on bank stocks

- Continuation of Semiconductor Play

- Beneficiary in relation to Covid-19 (e.g. Moderna)

Closing Thoughts

I got to be honest - my investment journey was pretty much on limbo until this year and I have neglected proper upkeep to my blog, namely the Goals and Milestone section and the Portfolio section. It's high-time I do a clean up of these sections.

Recalibrating my Goals and Milestones, I decide to start up with some goals which should be be too much of a stretch:

- By end-2023 (Age 35): Fully recover from my loss from writing off Alita Resources

- Periodical: After 2022, inject at least SGD 9000 excluding dividends and bonus shares into portfolio.

- By end-2033 (Age 45): Portfolio to achieve sustainable dividend of at least SGD 6000 yearly. With a 5% dividend yield, this translate to a portfolio value of SGD 120,000. So within 11 years from today, the portfolio needs to grow by SGD 7300 on average yearly.

And when I'm ready, I'll add in stretch goals to once again expedite my march towards Financial Independence.

Outside of this clean-up, however, I think I will still be keeping current frequency of writing new posts on my blog, maybe give or take a couple of articles outside the usual quarterly portfolio updates.

Happy new year to everyone - may your investing journey go well going forward! (I'm ready to kick some ass on my investment efforts.)