These received substantial comments - a mixture of advice, encouragement and critique.

You can access the articles here if you wish:

- Cancel my savings plan in pursuit of greater investment opportunities?

- Cancel my savings plan in pursuit of greater investment opportunities? (2)

Okay, here we go!

Daniel asked:

Hi, did you surrender this policy eventually?

Anon asked:

"Just came across your post about this and am currently in the same position you were- should i surrender/sell policy to third party to take the loss and Invest it myself? Or just let it ride..I have commented to follow up on the post, then the idea of putting these in writing gave an opportunity to expand on my answers when compared to the original comments.

I chose a 5 year payment for myself but quite a big annual premium with 2 more to go.

Could I ask where you stand on this now a year later? And why did you choose a 20 year payment instead of 5 or 10 years of premiums?"

On trying to sell the policy but not succeeding, and then mulling choice between surrender or keep

Initially, I tried to get a quote for my policy, but I did not receive any replies. This boils down to the choice of surrendering or keeping.

Overall, with how my investing journey on the stock market was lacklustre for the past 18 months, it could be good to have a backup in case of investing FUBAR.

In the end, I have chosen to let it ride, and probably intend to leave it till maturity and beyond. But that's not all I had done to the plan.

Changing the rate of premium payment

But what else have I done?

I changed my premiums payment from monthly payment to yearly.

I am not so sure about the other savings plan out there, but in my case, one has to pay more for monthly premium charges - close to 2% - presumably some sort of administrative charges - which does not contribute to any returns. If you are giving your premiums monthly for other savings plan, do check with your financial planner.

Basically whatever returns I am meant to get for each year gets reduced 2% p.a if I kept the monthly premium up.

The length of the plan till maturity

The choice of 20 years instead of 5 or 10 years was a bit of an uneducated choice. I started on this plan before I started educating myself financially - primarily failing to appreciate how to better exploit the effect of compounding interest and not yet learning about other investment mediums.

A long time ago, I wrote a couple short posts on the effects of compounding interests:

- Effect of Compounding on Principle Amount (and Ongoing Fund Injection)

- Effect of Compounding Part 2 - Early Repayment for a HDB Housing Loan

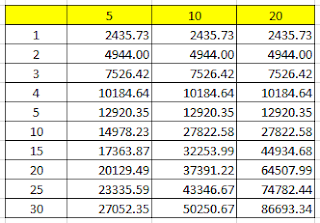

Let's run some numbers, shall we? We shall explore 2 conditions for the 5-year, 10-year and 20-year plan:

- Same amount of yearly premiums (pay 2400 yearly till maturity)

- Same amount of total premiums paid, spread over the period of the plan (48000 total sum)

- 3% annual returns before compounding

- Continuing to hold until policy year 30 without withdrawals or surrendering.

|

| Scenario 1 - Same amount of yearly premium (2400 per year) until maturity |

Based on the above, the Compounded Annual Growth Rate (CAGR) of this at the 30th policy year will be:

- 4.18% for the 5-year plan

- 3.65% for the 10-year plan

- 2.69% for the 20-year plan

But what about the second scenario?

|

| Scenario 2 - Same amount of total premium (48000), spread over the period of the plan |

The second scenario - that is, same amount of total premium, was what I failed to consider at the time when I decided to buy my savings plan. The CAGR from the first example applies, but the principal sum for the 5-year plan, and to a lesser extent, the 10-year plan is now working much harder than the 20-year plan as the total premium was given earlier.

So Anon, if you are reading this, while it is up to your discretion based on your preference or risk appetite, I feel it should be fine to keep the savings plan. For your own info-gathering though, it is also no harm in trying to get a quote for the sale of your savings plan. You may garner some interest as it is more than half-way through your plan anyway, unlike myself.

Readers, do you have any savings plan or any experience to share regarding it? What are your thoughts about your savings plan?

Thanks for reading.

Hi, if you had a balanced diversified portfolio then you wouldn't need any backup. But if you are just stockpicking and 100% of your portfolio is in the property sector, then you need a backup. While many claim such plans are no good, the truth is that these plans might end up having better returns than the portfolio of many below average investors. When I first started I bought NTUC Living policies and these have actually done very well and provided both diversification and protection (and I can sell them for above surrender value)

ReplyDeleteHi HW,

DeleteThanks for sharing!

In the short to mid-term (< 10 years), I do not see myself diversifying beyond pure stock-picking, so I guess the backup does still have a place, haha.

I'm curious about the returns for the NTUC Living policies, if you're comfortable sharing?

I also have Living policy for 20 years. Annual return (non compounded) is only 2%+. Good or not is up to individual. The Protection one is 30 years, 3%+ return. The returns are nothing to shout about. Took a long time to break even.

ReplyDeleteI bought them in case I suddenly kaput and my family got some money to tie through.

This comment has been removed by the author.

DeleteHi, I think you might have taken up some extra riders that increase the cost and reduce the return. I have been getting 3%+ CAGR over 20 years plus as well, though perhaps it depends on the entry year. See: https://investmentmoats.com/budgeting/do-your-insurance-saving-plans-endowment-give-you-3-to-5-returns/.

DeleteBut I agree with your general point, its good to have some backup if you do not have a diversified portfolio yet. When starting out with a small amount, we may want to take more risk to get higher returns. But hopefully later, when portfolio size is big enough, we will be able to steer it to become more diversified and towards the efficient frontier