Hi readers, in the blink of an eye, we have already ended the 1st quarter of 2022. It is very eventful one, marked with my first entry into US stock market, first time buying stock using leverage, my first child being born, further easing of Covid-19 measures among all the matters.

Unfortunately, the year being eventful also went both ways, including negative ones such as the invasion of Ukraine by Russia. Keeping my fingers crossed that Ukraine does not fall. There is no place for war in the modern world and it is a shame this happened.

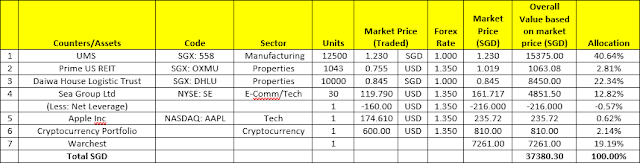

Overall, portfolio took a heavy hit earlier, falling as much as 15% initially. Although it has made some recovery, it remains some ways off the high seen in my 4Q2021 update.

See: Link to Main Portfolio page

Contents:

Portfolio (1Q2022 - 31 March 2022)

Performance

Some commentary on my portfolio

- First foray into US stock market! It felt like the right time to add some US-listed Tech. However, I limited my exposure as I do not want to overextend my exposure at this point.

- UMS fell heavily from a high of ~1.50 down to its present day quote, but thankfully still in the positive.

- In my 4Q2021 update, I shared how I felt bank may be one of the sector to focus on. I simply couldn't get a feel what is a decent entry price (as with my hesitation for the past few years as well).

- Crypto portfolio also fell substantially and I think it will be some time being we see the high. HODLing regardless.

Transactions and Dividends

(a) Transaction Summary

- Sold 2400 units of Wilmar at SGD4.39 (Net gain ~SGD 720)

- Lost 550 SGD messing around with intraday/short-term trading on US market

- Bought 30 units of Sea Group Ltd (NYSE: SE) at 92 USD each

- Collect 1 free Apple share (NASDAQ: AAPL)

- Received 43 units of Prime US REIT in scrip dividends from UMS in end-March 2022

Thoughts

On the Investment Front

Portfolio took a hit but thankfully made some recovery later on. Later on, I decided to enter the US stock market as I felt it was challenging as of late to invest further SGX-listed stocks (read: good price) and started looking elsewhere, and it just so happens there were stocks in the US-listed tech sector at a good entry point.

Signing up with Moomoo kickstarted this foray into US-listed stocks and also got me a free Apple share. You can use my referral to sign up as well if you are keen.

My Referral: https://j.moomoo.com/00gQ17

Personal

The first biggie - my first child was born in mid-February this year! With that, I see heavy cash outflow over the next few months as I pay off hospital bills (currently charged to OCBC Cashflo card) before it stabilises. I am very thankful that the government supported by means of Baby Bonus so we felt less stung financially. It has been a taxing period (especially for my wife) as we juggled duties for caring for him.. Here is to hoping I keep up on carrying out my duty well as both a husband and a father. I am also thankful my family has lent enormous support in caring for the baby as well.

The second biggie - have received 2 months in bonus from work (the most I have ever seen in my career to date), which further cushions the financial impact of welcoming our firstborn into the family. Nevertheless, I need to be more prudent and probably take a more cautious stance with my investment.